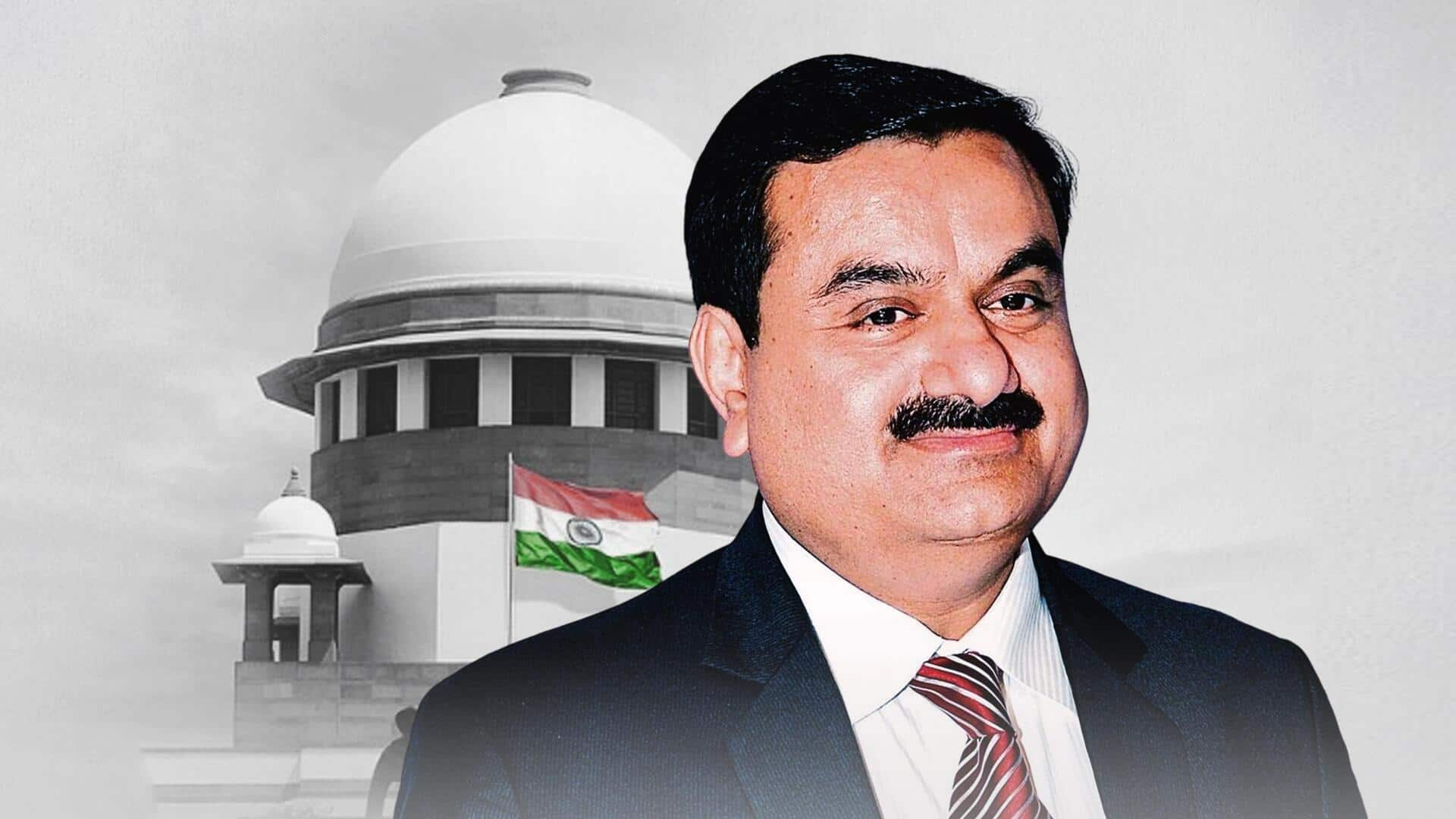

Adani-Hindenburg case: SC gives clean chit to Adani, backs SEBI

What's the story

In a huge victory for the Adani Group, the Supreme Court said the George Soros-led OCCRP's report cannot be used to challenge SEBI's investigation into the US-based short seller Hindenburg case. Chief Justice DY Chandrachud and justices JB Pardiwala and Manoj Misra, in their ruling, found no grounds to transfer the probe to a special investigation team, giving a clean chit to Adani Group.

Insights

What did George Soros-backed OCCRP report allege?

Organized Crime and Corruption Reporting Project (OCCRP) report on Adani Group stirred a storm months after Hindenburg Research targeted the conglomerate. In the report, which came out in August 2023, OCCRP claimed that millions of dollars were invested in certain publicly traded stocks of Adani Group via 'opaque' Mauritius funds. Adani Group called these allegations baseless, unsubstantiated, and rehashed from Hindenburg's claims.

Details

Third-party sources can't be relied on: SC

"Reliance on newspaper reports and third-party organizations to question the statutory regulator (SEBI) does not inspire confidence. They can be treated as inputs but not conclusive evidence to doubt SEBI's probe," the apex court said today. SEBI probed 22 out of 24 cases tied to Hindenburg Research's claims. The SC had granted SEBI three months to complete the investigation for the remaining two cases.

Details

Adani Group was accused of artificially inflating its share price

Lawyers Vishal Tiwari and ML Sharma, along with Congress leader Jaya Thakur and activist Anamika Jaiswal, filed petitions on the matter. Their claims suggested that the Adani Group artificially inflated its share prices and that the shares of some group entities had fallen sharply after the report by Hindenburg Research on January 24 last year.

Twitter Post

Truth has prevailed: Gautam Adani

The Hon'ble Supreme Court's judgement shows that:

— Gautam Adani (@gautam_adani) January 3, 2024

Truth has prevailed.

Satyameva Jayate.

I am grateful to those who stood by us.

Our humble contribution to India's growth story will continue.

Jai Hind.

Insights

'Investigation should be transferred only under exceptional circumstances'

The SC, explaining why it denied the request to transfer the probe to an SIT, said the investigation should be transferred only under exceptional circumstances, and such a power can't be used without a strong, logical justification. The SC also ordered the government and SEBI to check whether Hindenburg has ignored rules in shorting the market and to take action accordingly.

Insights

Hindenburg's report wiped off $86bn m-cap of Adani Group stocks

Hindenburg Research is a forensic financial research firm that analyses equity, credit and derivatives. It has a track record of finding corporate wrongdoings and placing bets against the companies. Hindenburg, in its January 2023 report, accused Adani Group of creating and managing "a vast labyrinth of offshore shell entities" in tax havens. The report set off an $86 billion rout in the group's m-cap.

Insights

How Adani responded to Hindenburg report?

A week later after the Hindenburg report came out, the Adani group called the report baseless and termed the allegations "unsubstantiated speculations." The conglomerate argued that the report is not just an "unwarranted attack on any specific company but a calculated attack on India, the independence, integrity and quality of Indian institutions, and the growth story and ambition of India".

Insights

Gautam Adani has faced scrutiny from Modi's critics

Gautam Adani, hailing from Gujarat in western India, built his empire after starting out as a commodities trader. His connection with Prime Minister Narendra Modi has faced continuous scrutiny from Modi's critics. Until the Hindenburg report came out, Adani was the world's third-richest man but dropped down the ranks to number 15 on the Forbes list after the rout in Adani group stocks.

Insights

Investors rejoice after SC's verdict

Notably, shares of Adani Group companies jumped as much as 11% following SC's verdict today. Adani Ports and SEZ rose by 2%, while Adani Enterprises saw a 5% jump. Adani Wilmar, Adani Green Energy, Adani Power, Adani Total Gas, and Adani Energy Solutions witnessed gains ranging from 3% to 11%. Meanwhile, Ambuja Cements, ACC, and NDTV shares also climbed by 1-6%.