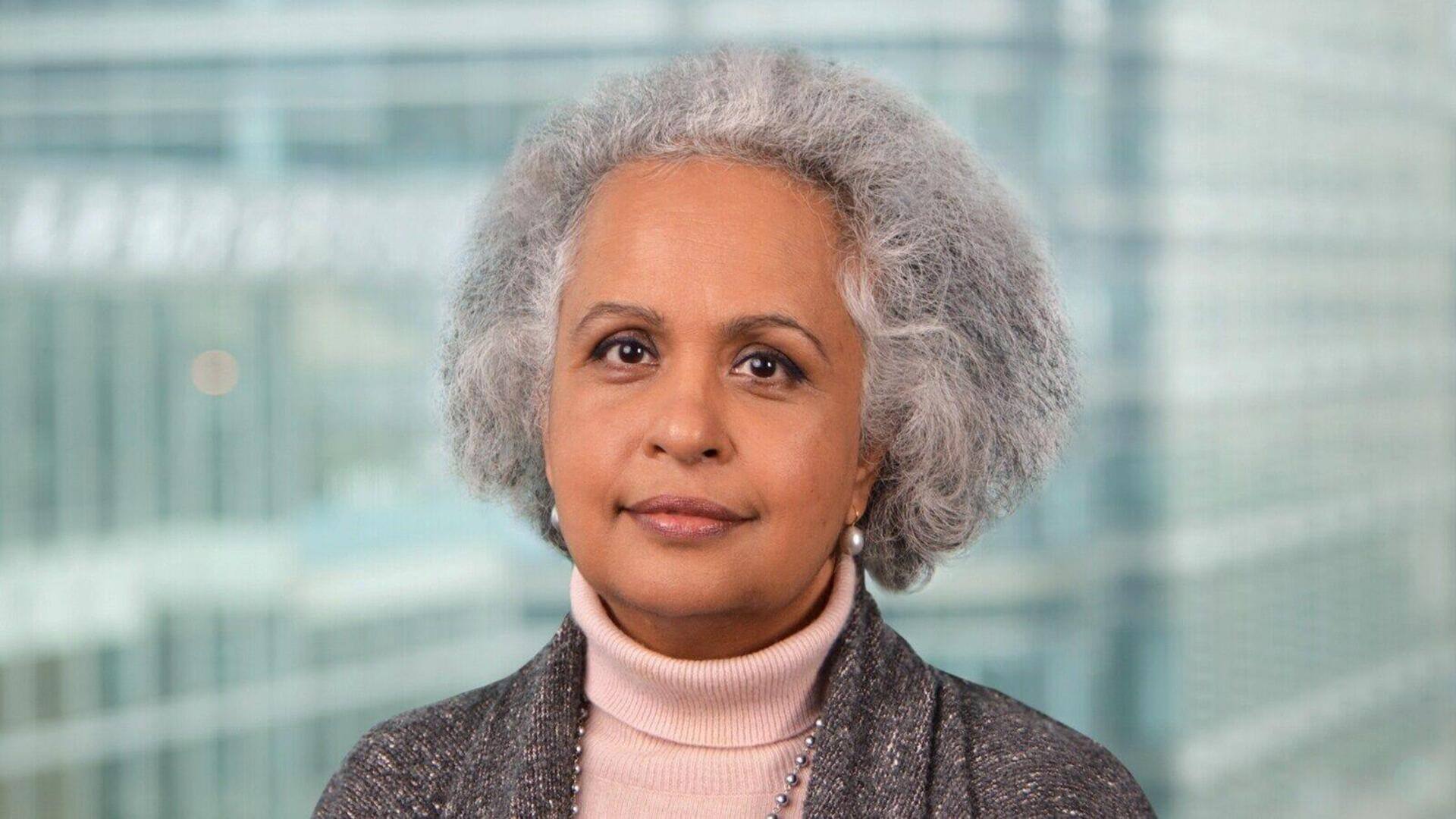

Meet Pam Kaur, HSBC's first female CFO in 160 years

What's the story

In a historic move, HSBC Holdings has appointed Pam Kaur as its new Chief Financial Officer (CFO).

This is the first time in the bank's 160-year history that a woman has held the executive position.

Kaur, an HSBC insider, succeeds Georges Elhedery who moved to the role of CEO earlier this year.

Career progression

Kaur's journey and experience at HSBC

Kaur started her career with HSBC in April 2013 as the group head of internal audit.

She was subsequently promoted to Head of Wholesale Market and Credit Risk, and Chair of the new enterprise-wide non-financial risk forum in April 2019.

In January 2020, Kaur became the Group Chief Risk Officer and assumed responsibility for Compliance in June 2021.

Professional background

Kaur's extensive experience in global finance

Before joining HSBC, Kaur served in various senior roles at other global financial institutions.

Her positions included Global Head of Group Audit for Deutsche Bank; CFO and COO of the Restructuring and Risk Division, Royal Bank of Scotland Group plc; and Group Head of Compliance and Anti-Money Laundering, Lloyds TSB.

She has also served as Chief Compliance Officer, Citigroup International; Global Director of Compliance, Global Consumer Group, Citigroup; and non-executive Director of Centrica plc.

Education and positions

Kaur's academic achievements and current roles

Kaur holds an MBA in Finance and a BCom (Hons) from Punjab University in India.

She is also a Fellow member of The Institute of Chartered Accountants in England and Wales.

She currently serves as a non-executive Director of Abrdn plc, in addition to her new role as CFO at HSBC Holdings.

Strategic changes

HSBC's future plans and changes

HSBC has also announced plans to restructure the bank into four distinct businesses from January 1, 2025.

These include the Hong Kong unit, the UK unit, the corporate and institutional banking unit, and the international wealth and premier banking unit.

Notably, Kaur's appointment comes as HSBC focuses on continuity as it transitions from restructuring to growth amid rising geopolitical risks and an end to interest rate hikes.