What is Paytm Gold and how to invest?

What's the story

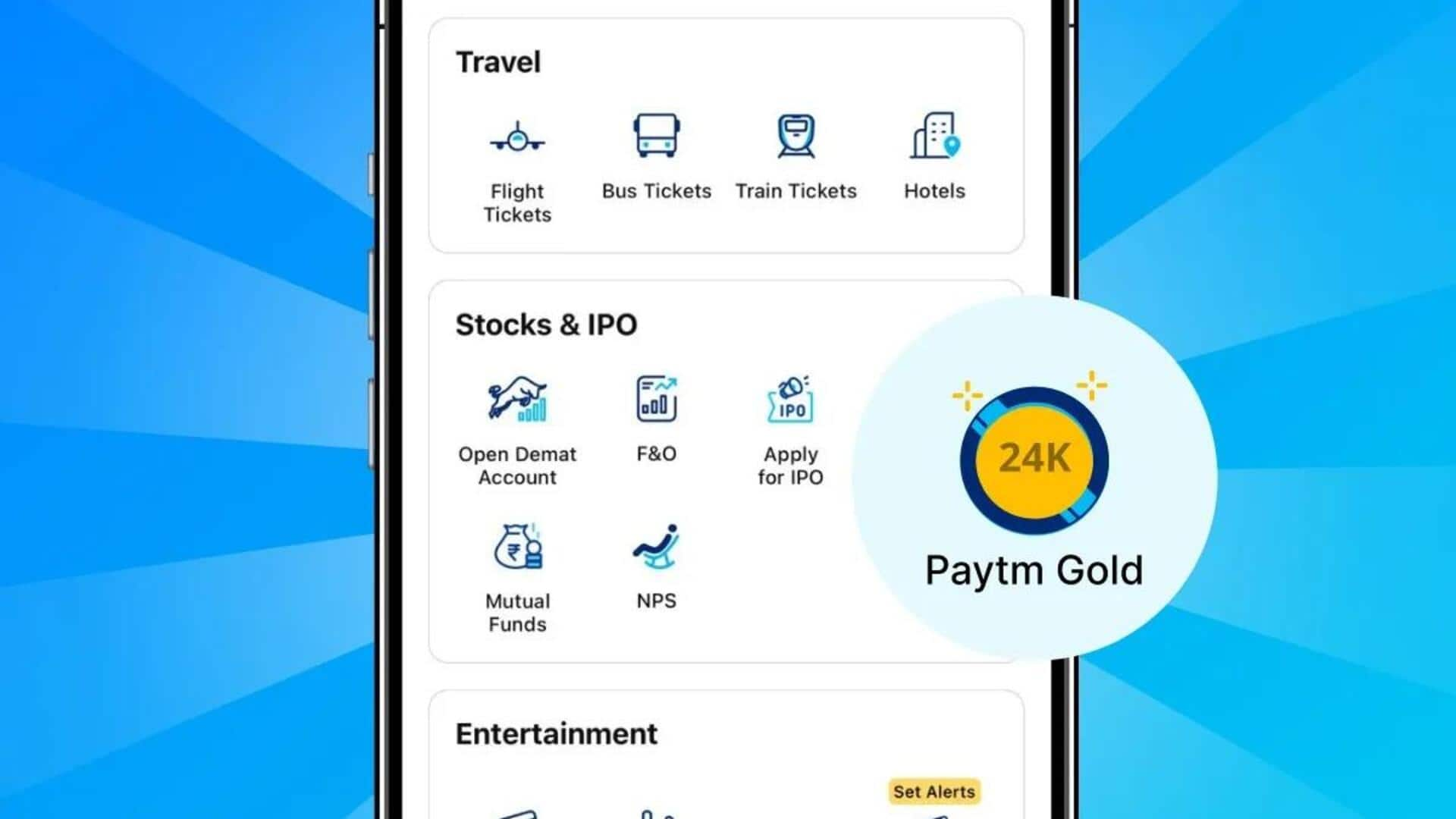

Paytm, India's leading digital payments platform, has changed the way we invest in gold.

The company's innovative service, Paytm Gold, enables users to buy, store and sell gold electronically.

The modern approach takes away the worries of storage costs and purity that come with physical gold. You can start investing with as little as ₹11.

Partnership details

Collaboration with MMTC-PAMP

Paytm has partnership with MMTC-PAMP, a joint venture of a Government of India enterprise and PAMP Switzerland, to offer its digital gold service.

This collaboration allows users to buy 24K 99.99% pure gold.

Notably, the recent cut in basic customs duty on gold by the Indian government has made this investment option even more lucrative.

Service highlights

Key features of Paytm's digital gold service

Paytm's digital gold service comes with some key features. Users can buy gold anytime via the Paytm app, and once purchased, it is stored in MMTC-PAMP's insured vaults without any storage fees for up to five years.

The platform offers live updates on gold prices and lets users sell their digital gold with ease.

The price of gold on Paytm is determined by international bullion markets, ensuring it reflects current global trends.

Investment process

How to invest in digital gold?

Investing in digital gold through Paytm is a simple five-step process.

Users just have to search for "Gold" on the app or visit the "Stocks & Mutual Funds" category, select the SIP amount, check the current price (with GST), select a payment method, and get a confirmation of their transaction.

After that, their gold is safely stored in insured vaults of MMTC-PAMP.