How to claim tax deductions for health expenses

What's the story

In India, the corporate world's increasing emphasis on wellness and preventive healthcare has led to a surge in queries regarding tax deductions for wellness programs.

The Income Tax Act provides several sections for claiming deductions on health-related expenses.

This article explores these crucial provisions, helping individuals and companies navigate them for financial benefits.

Health insurance premiums

Understanding Section 80D

Under Section 80D of the Income Tax Act, you can claim deductions for the health insurance premiums you pay for yourself, your spouse, your children, and your dependent parents.

The maximum deduction limit is ₹25,000 for individuals under 60 years of age and ₹50,000 for senior citizens.

Within these limits, an additional deduction of ₹5,000 is allowed specifically for preventive health check-ups.

Medical treatment expenses

Benefits under Section 80DDB

Section 80DDB provides deductions for the expenses incurred on medical treatment of specified ailments. It is applicable to individual taxpayers and Hindu Undivided Families (HUFs).

The maximum deduction limit is ₹40,000 for individuals below 60 years of age, and ₹1 lakh for senior citizens aged 60 years and above but below 80 years. The limit of ₹1 lakh also applies to super senior citizens aged 80 years or more.

Deduction for disabled dependents

Exploring Section 80DD

Section 80DD provides tax benefits to individuals or HUFs with a dependent family member with a disability.

It includes expenditure on medical treatment, including nursing and rehabilitation of disabled dependent relatives, and premiums paid for specific insurance policies intended for such situations.

The fixed deduction of ₹75,000 under this section is available regardless of the actual expenditure incurred; however, in case of severe disability, it goes up to ₹1.25 lakhs.

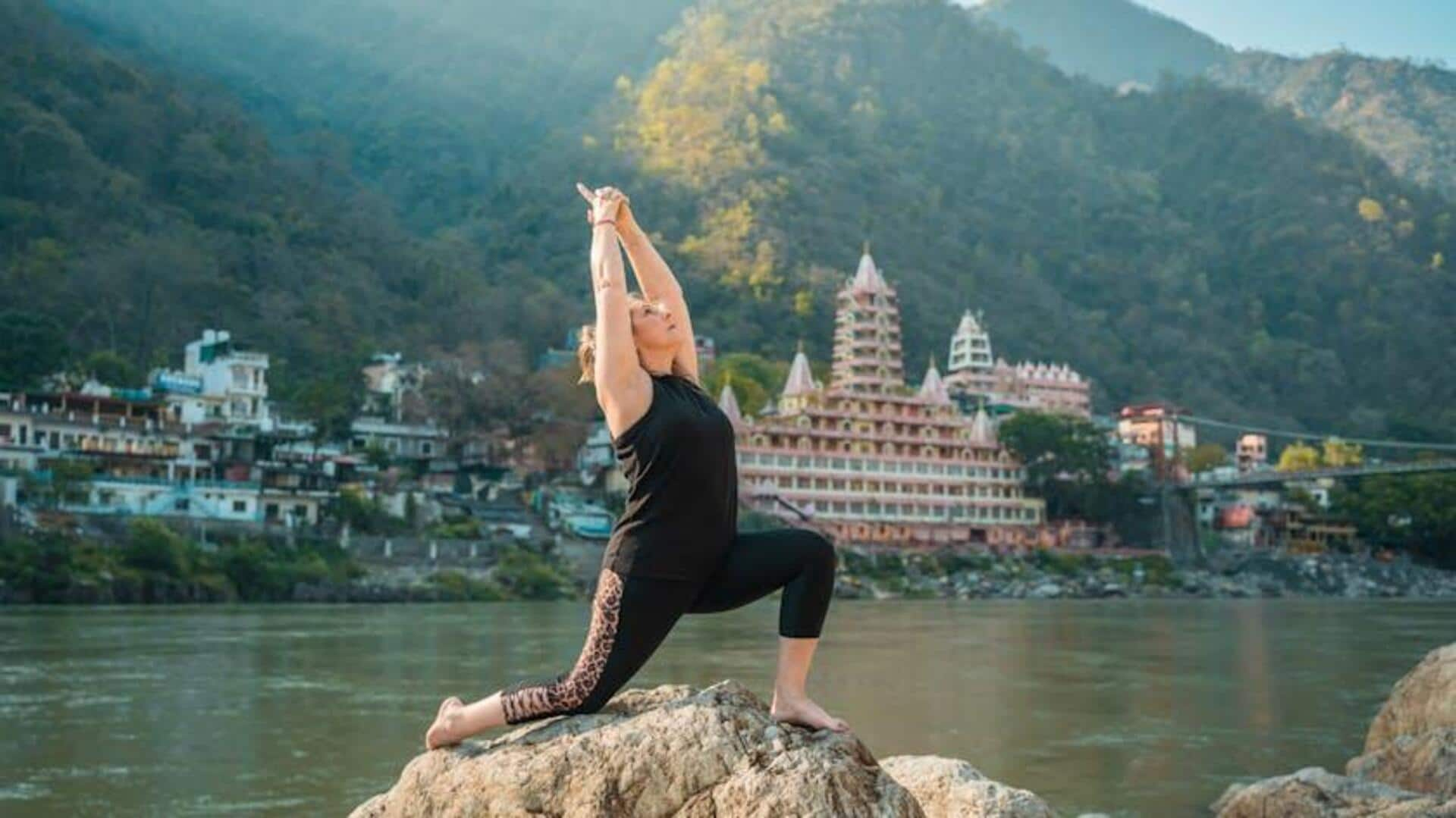

Allowances for health and fitness

Leveraging Section 10(14)

Section 10(14) and Rule 2BB provide exemptions on allowances for personal expenses incurred in the performance of duties, and this can include fitness activities.

This, in essence, promotes wellness through tax advantages.

By comprehending these provisions of the Income Tax Act, one can make strategic investments in health and fitness that foster well-being while simultaneously yielding financial benefits.