How to get a new PAN card instantly on email

What's the story

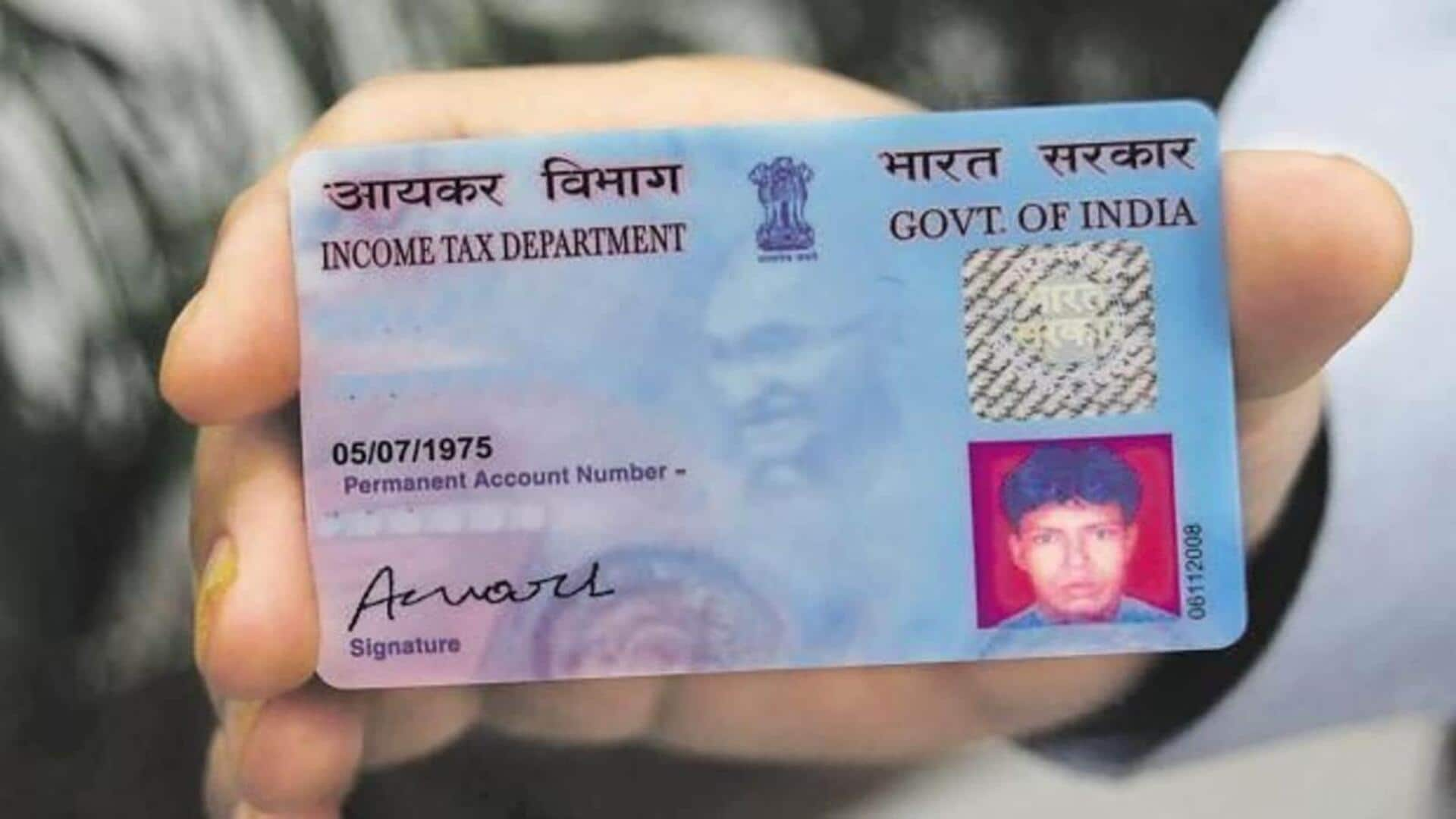

The Income Tax Department has launched a new facility for taxpayers, allowing them to get their Permanent Account Number (PAN) through email.

The service is available for existing PAN card holders who don't require any changes in the income tax database.

To avail the service, it is important to have the correct email address updated in the income tax records.

The department has confirmed that existing PAN cards (without QR code) will remain valid under the upcoming PAN 2.0 project.

Application process

Applying for a new PAN via email

To apply for a new PAN through email, taxpayers first need to determine if their PAN is issued by NSDL or UTI Infrastructure and Technology and Services Ltd. (UTIITSL).

This can be checked on the back of the PAN card. Depending on the issuer, different steps have to be followed to receive the PAN in digital form/email.

The e-PAN may take up to 30 minutes to arrive at your registered email address.

Steps to follow

Obtaining PAN card from NSDL website or UTIITSL

Visit NSDL online services, enter PAN, Aadhaar, and date of birth, and the click on submit. Next, verify your details.

Now, select the option for OTP, enter it, and validate the details. Choose your payment method and continue to complete the transaction.

Once the payment is successful, the PAN will be sent to the email address registered in the income tax database.

The steps to get e-PAN from UTIITSL are similar.

Free service

e-PAN will be delivered free of cost

An e-PAN will be delivered to the registered email address free of cost in up to 30 minutes. However, a physical PAN card will need an application and a fee of ₹50 for domestic delivery.

For international deliveries, an additional charge of ₹15 plus actual India Post charges will be applicable.