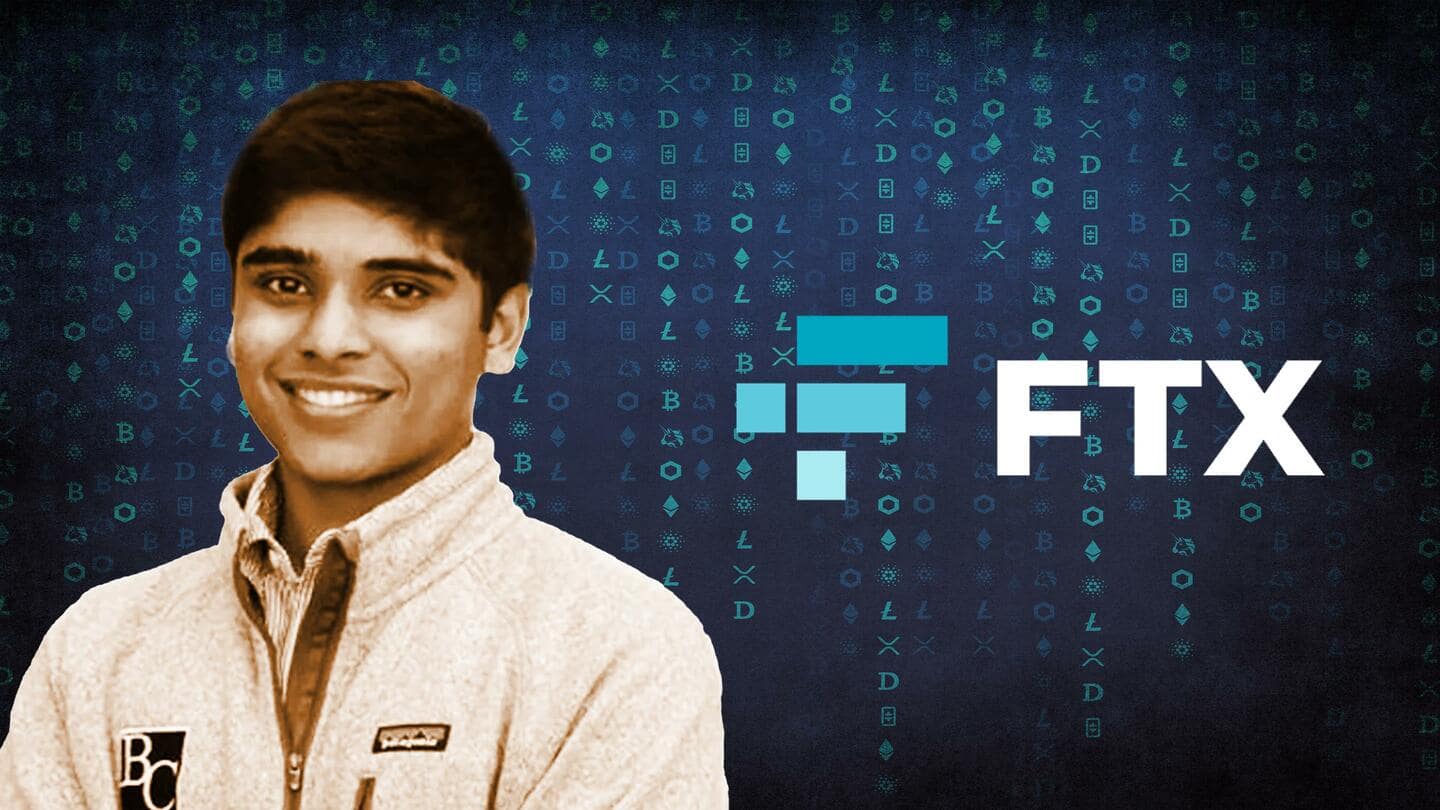

Who is Nishad Singh, the Indian-origin executive who ran FTX?

What's the story

FTX, once the third-largest cryptocurrency exchange in the world, and its talismanic leader Sam Bankman-Fried have fallen from the upper rungs of the crypto universe.

Its inner circle, people close to Bankman-Fried, is under investigation. Among them is Nishad Singh, an Indian-origin executive who was a housemate of Bankman-Fried.

Here, we take a look at who he is and what he did at FTX.

Role

Singh worked in Alameda before joining FTX

Singh joined FTX as its Director of Engineering in 2019. Prior to joining the cryptocurrency exchange, he was part of its sister organization Alameda Research, which is at the center of the current controversy.

He joined Alameda in 2017. According to his now-defunct LinkedIn profile, Singh earlier served as a software engineer at Facebook, where he worked on machine learning.

Switch

He joined Alameda after visiting Bankman-Fried

The job at Facebook was a "dream," Singh once said in an FTX podcast in 2020. However, he decided to join Alameda after visiting Bankman-Fried at an apartment.

"I think I first visited Alameda when it was like a month into its existence," he said. It was "obvious that the things they wanted to do were really important and really fruitful," Singh added.

Information

He graduated from the University of California, Berkeley

Singh studied at Crystal Springs Uplands School, a top private school in Hillsborough, California. He then graduated from the University of California, Berkeley, with a bachelor's degree in electrical engineering and computer science.

Inner circle

Singh lived in a luxury mansion in the Bahamas

A recent report by CoinDesk revealed that Singh was among the nine housemates of Bankman-Fried who helped the erstwhile billionaire run FTX. They reportedly lived in a luxury mansion in the Bahamas.

Caroline Ellison, the CEO of Alameda Research, and Gary Wang, the co-founder and chief technology officer of FTX, also lived in the same house.

Involvement

Singh may have played a role in moving funds

According to a recent report by The Wall Street Journal, FTX moved $10 billion of customer money to Alameda.

A person familiar with the matter said, "Gary, Nishad, and Sam control the code, the exchange's matching engine, and funds."

"If they moved them around or input their own numbers, I'm not sure who would notice," the person added.

Collapse

Alameda Research's balance sheet heavily dependent on FTT

FTX's fall began when CoinDesk published a balance sheet that showed Alameda Research is heavily dependent on FTT, FTX's native coin. This raised questions about FTX's liquidity.

This was followed by an announcement by Binance, FTX's rival, about its decision to liquidate its FTT holdings.

Binance then decided to acquire FTX, too. However, it later backed out of the deal after due diligence.

Information

FTX has filed for bankruptcy

Binance's decision to pull out of the deal was influenced by allegations against FTX about mishandling customer funds and an investigation by the US Securities and Exchange Commission (SEC) into the same. A couple of days later, FTX even filed for bankruptcy.