PSB Consolidation: Cabinet gives nod to merge state-owned banks

What's the story

Taking another step towards consolidation of public sector banks (PSBs), the Union Cabinet approved an "Alternative Mechanism" for constituting an inter-ministerial panel for overseeing the mergers of 21 state-run banks.

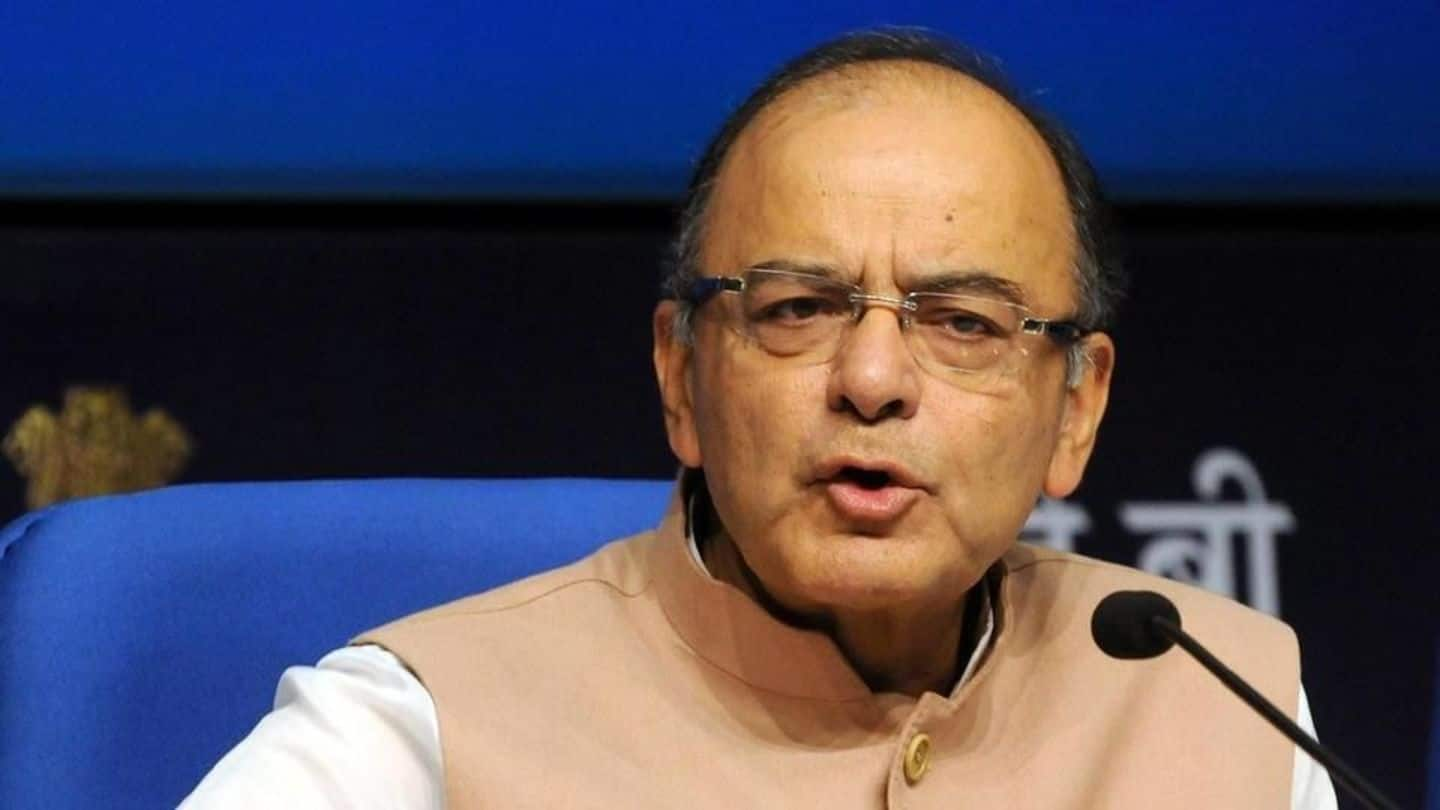

Finance Minister Arun Jaitley said their objective is to "create strong banks."

The government's move comes only a day after PSB employees went on a nationwide strike, protesting against the Centre's consolidation proposal.

Alternative Mechanism

PM Modi to decide on members of AM panel

Arun Jaitley would lead the Alternative Mechanism (AM) while PM Narendra Modi would appoint the panel members.

Jaitley said the merger proposals would come from PSB boards, after which the panel will take decisions based on commercial considerations.

However, questions are being raised about the timing and purpose of the consolidation, when most PSBs are reeling under losses and stressed loans.

Consolidation

The idea of merging state-owned banks

The consolidation of PSBs was initially recommended by former the RBI Governor M Narasimham around 1991.

He suggested the government to merge PSBs into a three-tier structure, having three large banks with a global presence at the top.

Later, in 2014, RBI's PJ Nayak Committee on governance of state-owned banks' boards also recommended that the government either merge or privatize the PSBs.

The Centre

Number of state-owned banks to be reduced

The Centre wants to reduce the number of PSBs to 10-15 through mergers and acquisitions, ensuring none of them become "too big to fail."

It expects the banks would better manage risks and achieve economies of scale and operational efficiency, after merging.

It also hopes the consolidation would help PSBs to deal with their credit portfolio and withstand shocks in a better manner.

Information

The state-run banks in India

There are 21 PSBs in India, including SBI. The government said individual boards of these banks could decide on whether to go in for a merger. However, being the largest shareholder of the PSBs, the government can affect the decisions of the boards.

Challenges

Not all banks agree consolidation is the way to go

Some feel "efficiency" may not be the outcome of consolidation as there will be several challenges in the process, including current asset quality issues, human resources' integration, and cultural fit.

Pointing to SBI's merger with five associates and Bharatiya Mahila Bank, they said SBI's asset quality deteriorated after that.

PSBs account for a majority of the Indian banking system's Rs. 10 trillion stressed loans.

Quote

Banking system will become more inefficient: Former RBI Dy Governor

Former RBI Deputy Governor and Former CMD of Punjab National Bank, KC Chakrabarty, stated, "The merger will result in large-scale financial repression. Banking system will become more inefficient and too-big-to fail by merging two inefficient banks."

Capital Infusion

Merger of PSBs at this time is ill-advised: Experts

The Centre would infuse a capital of Rs. 20,000cr in the PSBs to support them, as promised earlier.

However, experts say consolidation wouldn't result in the government escaping the burden of infusing additional capital.

IIM Ahmedabad Finance Professor Ram Mohan suggested instead of mergers, the government should focus on infusing capital or reduce stake in weak banks while bringing in an equity partner.