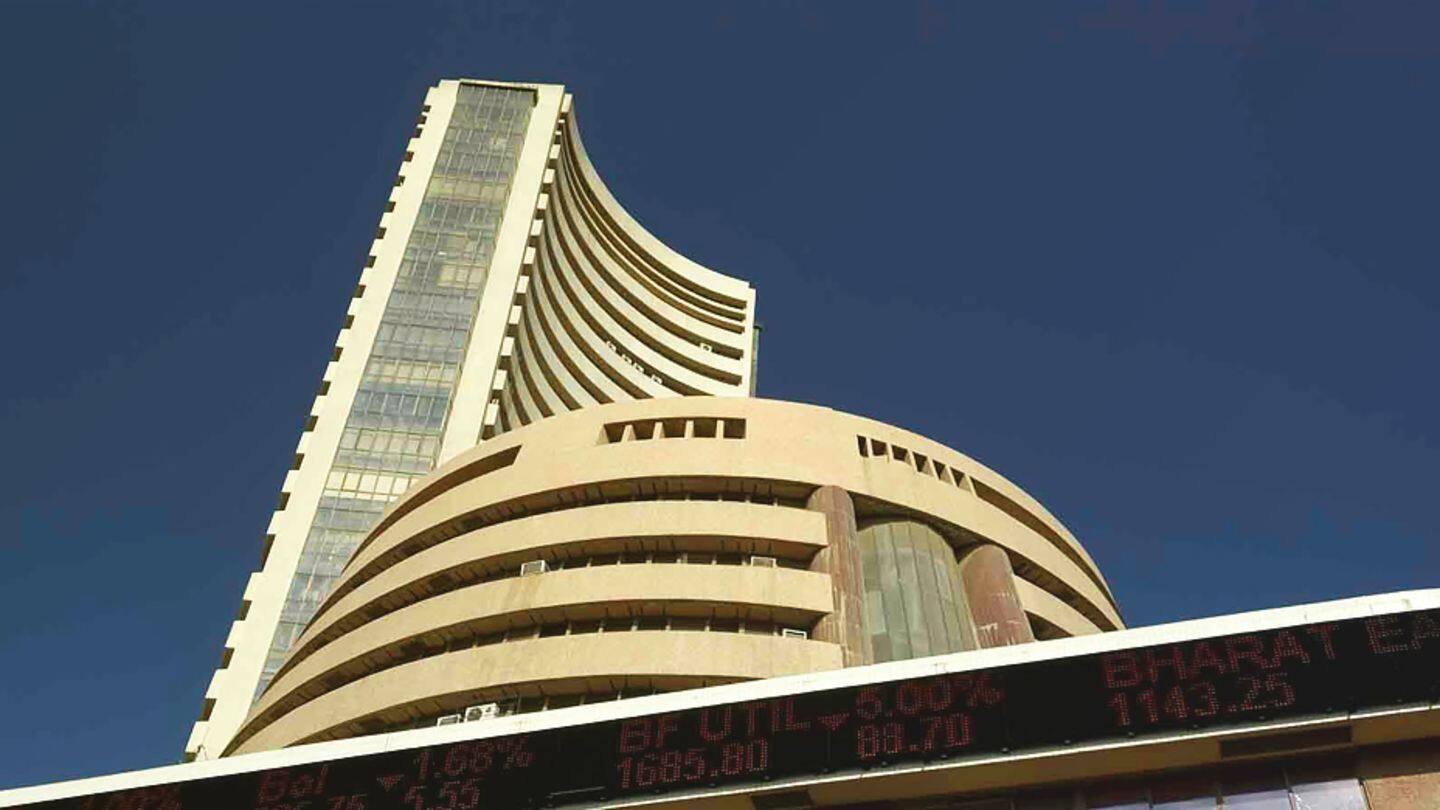

BSE seeks US regulator nod for its India International Exchange

What's the story

Asia's oldest bourse BSE is planning to seek US regulator's nod for holding the status of Foreign Board of Trade (FBT) for its India International Exchange in GIFT city in Gujarat.

"We are in the process of applying to seek approval from Commodities Futures Trading Commission (CFTC) as an FBT for our India International Exchange," BSE MD & CEO Ashish Kumar Chauhan said.

Explanation

What exactly is FBT?

FBT is any board of trade, exchange or market located outside the US. Some countries have obtained approval as FBT like in Singapore.

FBT allows US brokers to trade directly from their systems in derivative products offered by India International Exchange, the average volume of which has reached $400-500mn/day, Chauhan said.

NSE was also mulling a similar venture for Gujarat International Finance Tec-City (GIFT).

Information

BSE stopped trading their indices on foreign bourses

In February, on market regulator SEBI's instructions, the stock exchanges had said they will immediately stop trading of their indices on foreign bourses as part of a joint effort to stem the migration of liquidity to overseas markets.

Joint venture

BSE formed a joint venture with Ebix

On the proposed insurance platform, Chauhan said BSE formed a joint venture with US technology company Ebix to facilitate setting up an insurance distribution platform on lines of BSE StAR MF platform.

"Ebix and BSE will hold 40% each and the rest 20% will be held by other Indian entities or those nominated by Ebix and BSE. Initial capital is Rs. 25cr," Chauhan said.

A foray

BSE to expand its footprint as a financial supermarket

Seeking to expand its footprint as a financial supermarket, BSE has decided to foray into insurance distribution following the success of BSE StAR MF.

"We are filing with the insurance regulator IRDA for approval. We expect to be ready to commence operations in 3-4 months after regulatory approvals," Chauhan said.

Initially, BSE may not charge any fees for offering the platform as an aggregator.

Leverage

BSE-Ebix will leverage network of MF agents

"Ebix has a proven technology and business model for insurance distribution. Transactions in insurance are more complex than even mutual fund distribution," he said.

The joint venture company will leverage the network of MF agents close to 2 lakh across 3,000 towns/cities.

However, after 10 years of MF StAR platform, BSE has begun to charge Rs. 5/transaction from last month after the volumes soared.

Quote

Joint venture does about 20 lakh transactions per month

"The platform does about 20 lakh transactions (monthly). About 20% of the total investment in MF is routed through BSE. 30-40% of new money inflows are from us," Chauhan said. Meanwhile, BSE is also gearing up for launching commodities on the bourse from October 1.

Trading

BSE to keep bourse open till late night from October

Bombay Stock Exchange (BSE) said that it is ready to keep the bourse open till late in the night from October 1 for the equity derivatives.

India International Exchange at GIFT City functions till late at night to support trade in tandem with international markets.

"We have to handhold some 200 brokers for late night trading," Chauhan said.