Berenberg Capital Markets recommends Nanox Imaging, issues $65 Target BUY

What's the story

As the economy gears up for 2021, especially with COVID-19 still affecting us, experts are preparing investors for the next big reward stocks. In a year of closures, shutdowns, and low-productivity, the focus on medical research and innovation indicates that biotechnology stocks value will increase. Berenberg Capital Markets, a German Investment Banking and Financial Services firm, recommends Nanox Imaging (NASDAQ:NNOX) as a must-buy asset.

Do you know?

Nanox Imaging Ltd. is a leading Israeli and Japanese company

Nanox Imaging Ltd. is a leading Israeli and Japanese based company. Founded and managed by CEO Ran Poliakine, this company is instrumental in helping to produce a new and innovative system to expand X-ray accessibility and affordability in the healthcare system.

Innovation

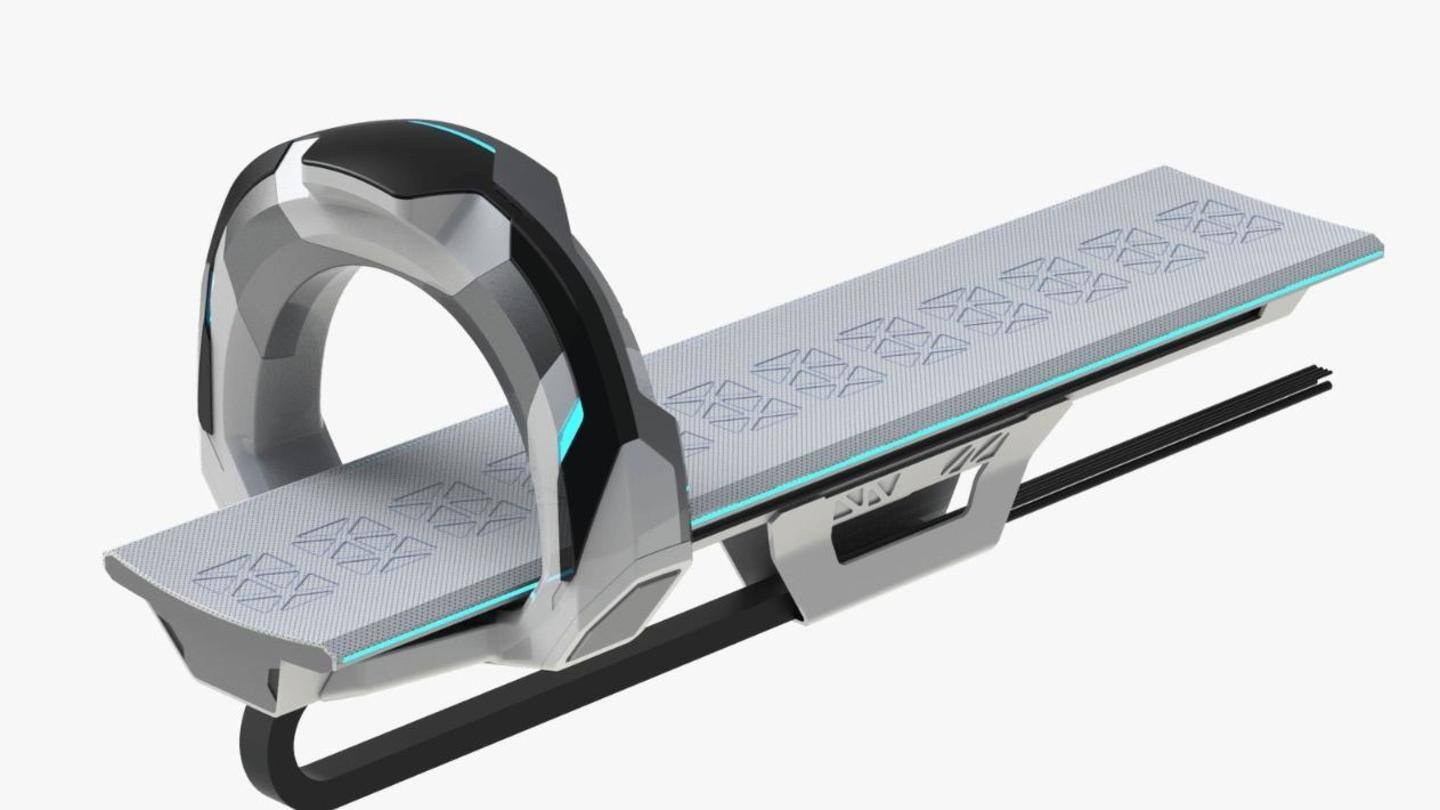

Nanox's medical imaging introduced a 3-D scanning using nanotechnology

While X-rays have not changed much since their inception in the 1800s, Nanox's medical imaging developed digital tubes and introduced a three-dimensional scanning using nanotechnology. They utilize new techniques, like a cold cathode tube, instead of the traditional hot cathode tube. This transition allows for more energy conservation than warm tubing, which loses almost all of its energy as heat intensity.

Berenberg

Berenberg based its assessment on Nanox's success at the RSNA

Berenberg Capital Markets, known for their top of the industry financial analysis, restated their confidence in Nanox and its potential price target to $65 per share. Berenberg based its assessment on Nanox's live demonstration and success at the RSNA Radiology Conference. The conference, held on December 3, was live streamed to over 11,000 participants in real-time globally, featuring expert accounts by leading radiologists.

Observation

Despite being a high risk stock, Nanox has immense potential

According to a Berenberg Flash Note Report, Nanox's demonstration was an "important event given the early-stage nature of the company." The report also explained that despite being a high risk/high reward stock, if Nanox expands into the X-ray imaging market, there is limitless potential. The next step for NNOX is to gain US Food and Drug Administration (FDA)'s confirmation to commercialize into major markets.

Quote

'FDA process is most significant one, a major re-rating event'

Ravi Misra, an analyst for Berenberg, deciphered that "Regulatory approval represents the next catalyst. The company reiterated its expectation around commercialization in H221 (i.e., key approvals ahead of this time)." "The company is working with several regulatory bodies around the world to secure approval; for our part, we think the FDA process is the most significant one and a major re-rating event," he added.

Support

Firms like Cantor Fitzgerald also recommend Nanox Imaging

Berenberg Capital Markets is not the only one advising its investors to consider long-term investment in Nanox Imaging. Recently, firms like Cantor Fitzgerald have recommended a high price target. As several reports give strong vibrations of market confidence in Nanox, financial analysts are awaiting more clinical analysis and statistical verification to ensure that the large-scale launch and product commercialization will bring expected triumphant results.