Multi-bagger gains in Ather IPO—Check who profits most

What's the story

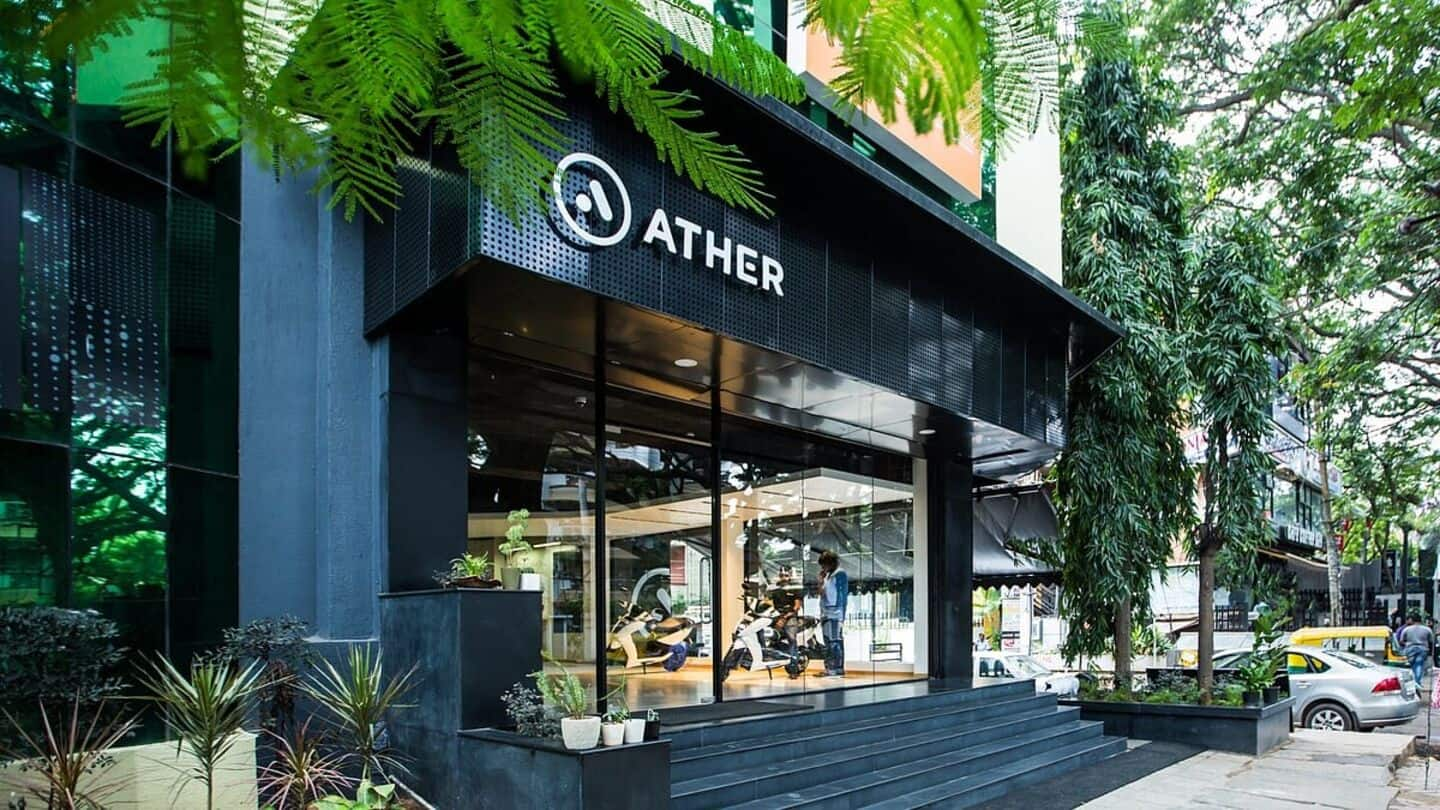

One of India's leading electric two-wheeler manufacturer Ather Energy is gearing up for its IPO next week.

The company's promoters and early investors are expecting huge returns from the public offering.

Among them is Tiger Global-backed Internet Fund III Pte, an early investor since 2015.

The fund owns a 6.56% stake or 1.98 crore shares in Ather Energy at an average acquisition price of about ₹38.58/share, the RHP revealed.

Expected returns

Investors poised for significant gains

The IPO's upper price band of ₹321/share values Internet Fund III Pte's stake at over ₹655 crore.

Singapore's sovereign wealth fund GIC, through Caladium Investment, and the National Investment and Infrastructure Fund (NIIF) are also likely to post strong gains.

GIC bought a 15.43% stake or 4.65 crore shares in Ather Energy at an average price of about ₹204.24/share, valuing its holding at ₹1,493 crore at the IPO price band's upper end.

NIIF's stake

NIIF's investment will be valued at around ₹655 crore

NIIF holds a 6.77% stake or 2.04 crore shares in Ather Energy at an average price of ₹183.71 per share.

This means its investment would be worth about ₹655 crore at the upper end of the IPO price band.

The company's largest stakeholder Hero MotoCorp owns a 38.19% stake or 11.51 crore shares purchased at an average price of ₹145.99 per share, now worth about ₹3,694 crore on the top end of the IPO price band.

IPO details

Ather Energy's IPO to open for subscription on April 28

Ather Energy has fixed a price band of ₹304-321 per share for its IPO, which opens for subscription on April 28.

Its anchor book opens on April 25, while the IPO subscription window will be open from April 28-30.

The issue size has been reduced to ₹2,980.76 crore from ₹4,000 crore earlier.

For the nine months ended December 2024, Ather Energy posted ₹1,578.90 crore revenue and a net loss of ₹577.90 crore, narrowed from ₹776.40 crore a year ago.