'Sugar daddy effect': Why some venture funds succeed, others fail

What's the story

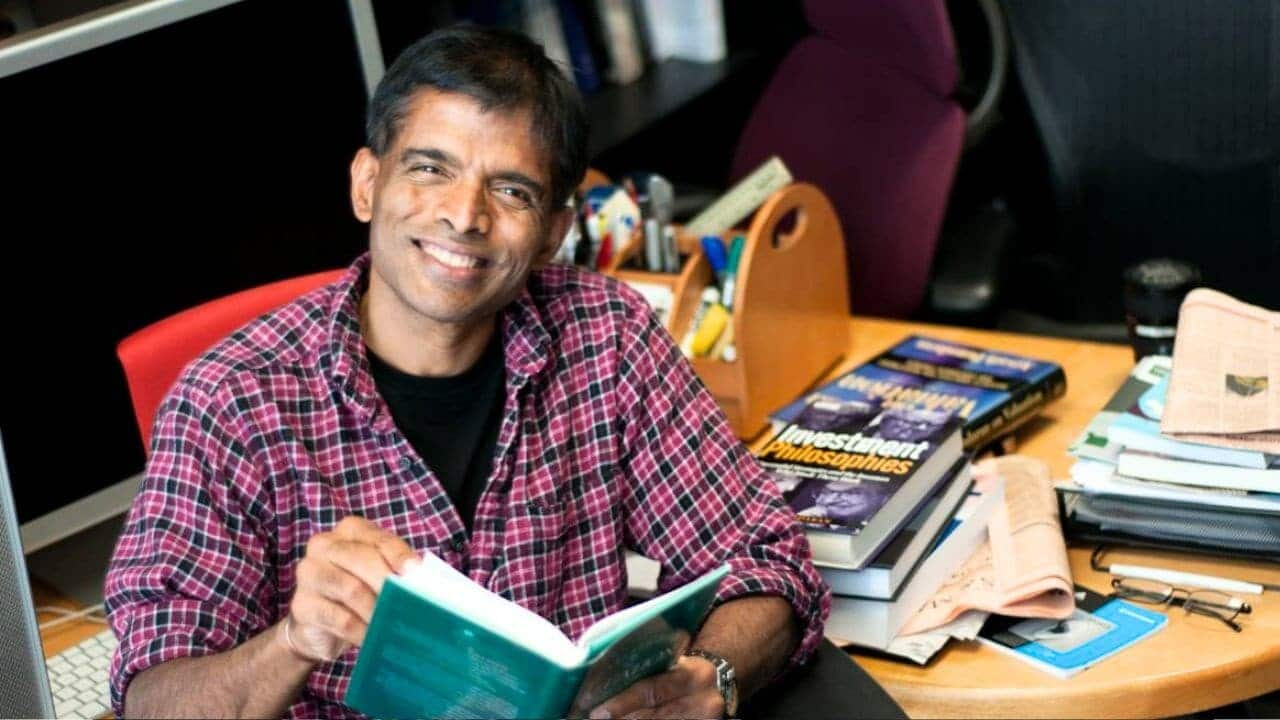

Aswath Damodaran, a well-known Professor of Finance at New York University's Stern School of Business, has brought the term 'sugar daddy effect' to the financial industry. The concept comes after popular business terms like 'founder mode' and 'monk mode' stirred online by other industry leaders. The term describes a phenomenon where large entities (sovereign wealth funds, venture funds backed by major corporations) make less diverse investments, due to their reliance on parent companies/governments.

Influence

Damodaran explains the influence of parent entities

Damodaran explained that the priorities of parent entities (which provide funding) greatly dictate what and how much they invest in. He shared this data at Stern School of Business today. The professor further noted that few firms have a corporate venture capital (CVC) arm/division responsible for CVC investments. This lack of independence from parent companies often results in less diverse investment portfolios.

Investment success

Google's venture investments thrived due to 'sugar daddy effect'

The 'sugar daddy effect' is evident in the success of Google's venture investments. Damodaran pointed out that Google benefited from investing beyond its comfort zone in start-ups such as Uber, Airbnb, and Slack early in their lifecycle. Meanwhile, tech giant SAP was forced to shut down its venture arm this year after the start-ups it supported raised over $12.9 billion over seven years.

Investment impact

How it impacts investment in low-emission fuels

Damodaran also spoke about how the 'sugar daddy effect' has particularly impacted investments beyond fossil fuels. He noted that while large sums have been invested in solar, wind, and hydro energy, only a fraction has been directed toward nuclear energy and other low-emissions fuels. This is because impact investors 'want to have their cake i.e. market-beating returns, and eat it too'. This directly impacts the efforts taken to tackle climate change.

Call to action

Damodaran calls for greater independence in fund management

Damodaran stressed on more independence for fund managers, a clear and unconflicted purpose, and parent companies' readiness to shut down unsuccessful ventures. He contended that this could result in more diverse and potentially successful investments. The professor's observations on the 'sugar daddy effect' provide a fresh perspective on venture capital investment strategies and their possible pitfalls.