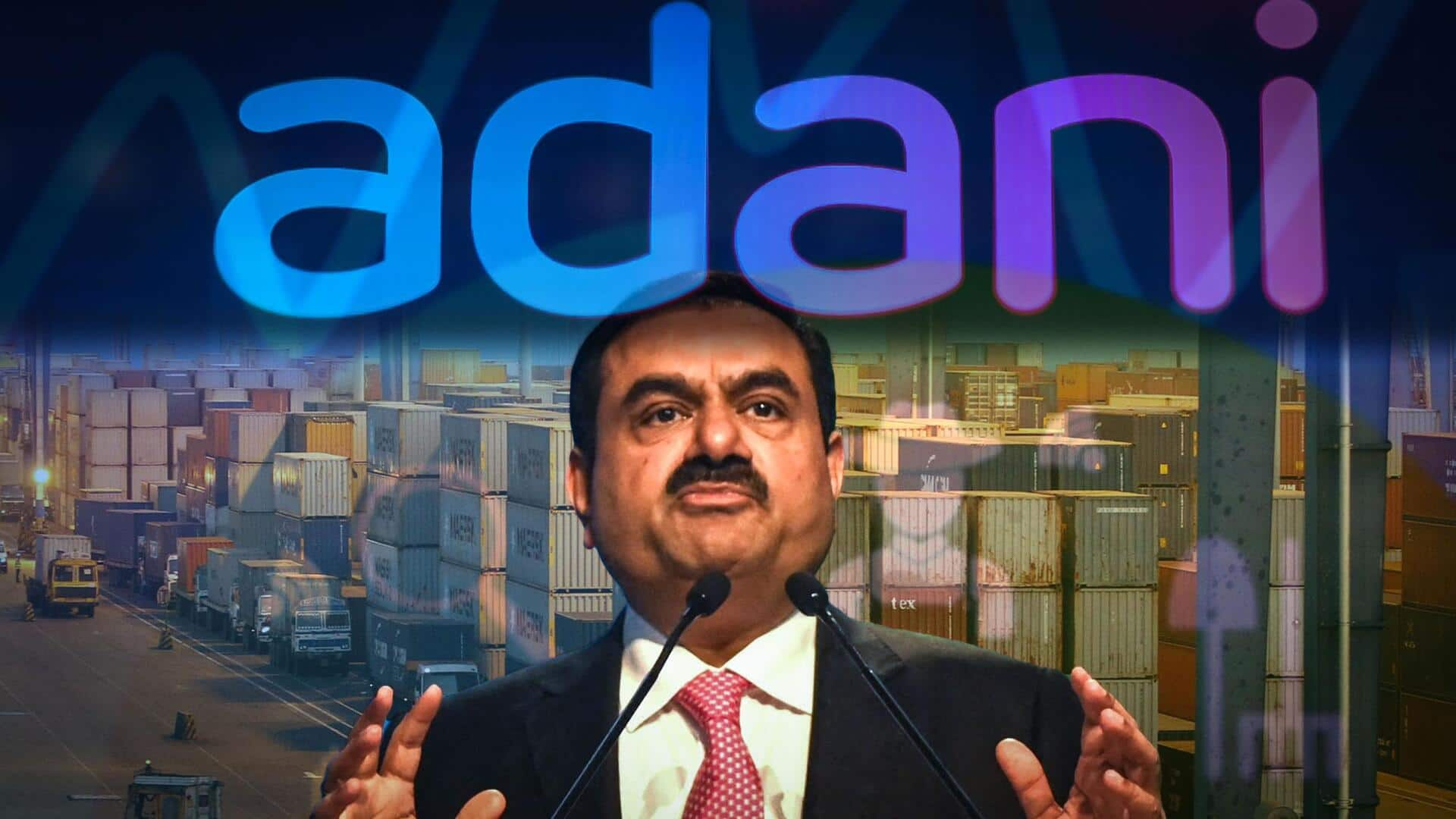

Supreme Court delays Adani-Hindenburg case hearing, Adani Group stocks dip

What's the story

On Friday, India's Supreme Court pushed back the Adani-Hindenburg case hearing to October 20.

In the meantime, Adani Group stocks, including Adani Enterprises, Adani Ports & SEZ, and Adani Power, took a hit.

Shares of Adani Enterprises dipped over 3%, while other group stocks like Adani Total Gas and Adani Wilmar fell over 1%.

The case centers on claims of stock manipulation by Adani firms.

Details

SEBI's status report and DRI's letter on stock manipulation

The SC planned to examine the latest status report, submitted by the market regulator Securities and Exchange Board of India (SEBI) during the hearing.

Last month, a Public Interest Litigation (PIL) accused SEBI of hiding crucial facts from the court and concealing a letter from the Directorate of Revenue Intelligence (DRI) about alleged stock manipulation by Adani firms.

In August, SEBI told the court it had wrapped up investigations into all but two allegations against the Adani Group.

What Next?

Hindenburg Research's allegations and market impact

In January 2023, US-based short seller Hindenburg Research accused the Adani Group of accounting fraud, manipulating stock prices, and improper use of tax havens.

These allegations led to a massive drop in Adani Group shares, erasing nearly $150 billion in market value at its lowest point.

Following these claims, the SC ordered SEBI to investigate and report its findings. A six-member expert panel was established in March to scrutinize regulatory aspects of the allegations.

Insights

Fresh plea questions integrity of the expert committee

Last month, a new plea was filed with the SC, questioning the integrity of the current expert committee investigating the Hindenburg report.

The plea called for a new panel made up of individuals with unblemished integrity and no conflicts of interest related to the Hindenburg report.

The results of these proceedings could significantly impact the Adani Group and its future operations.