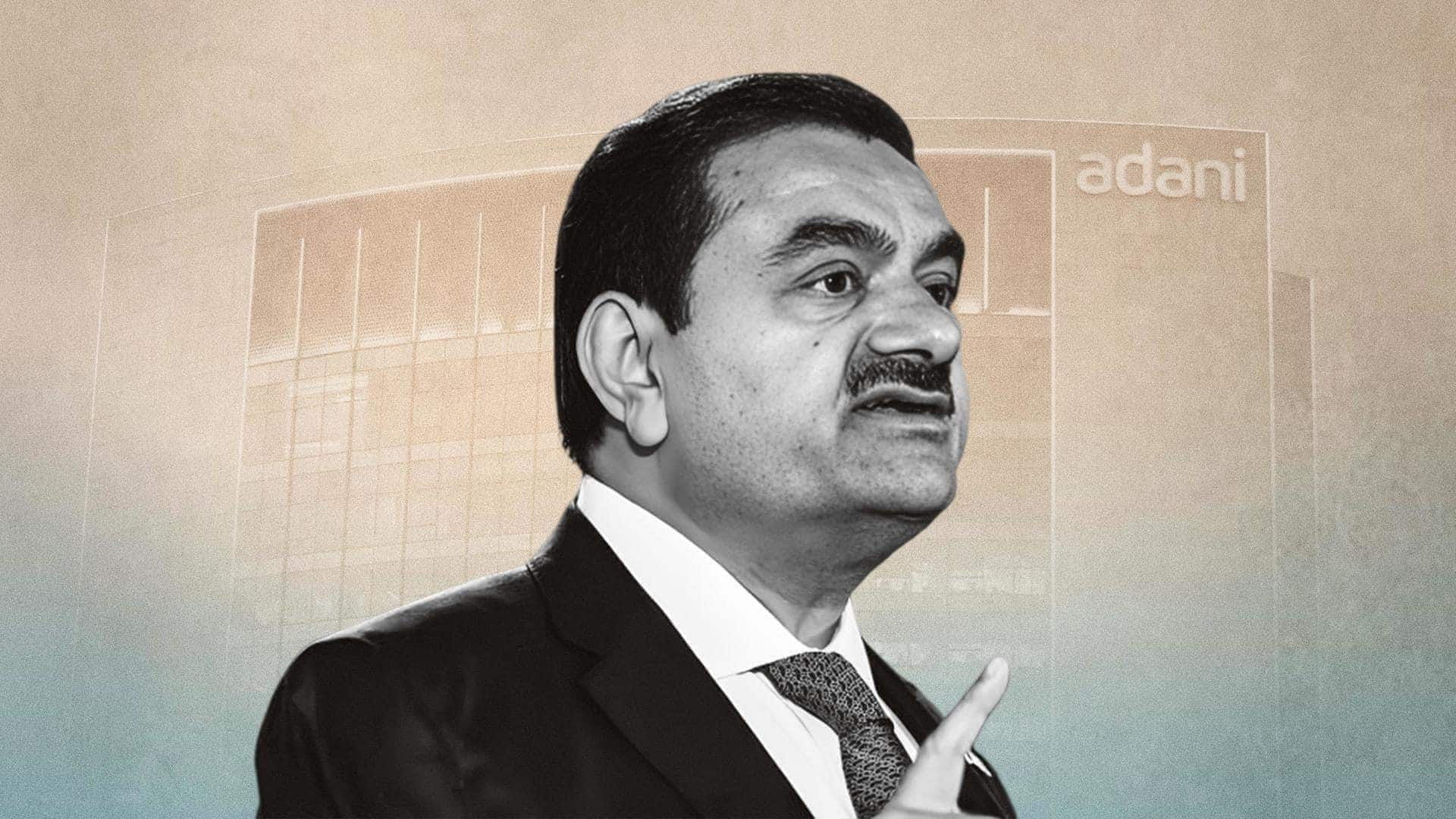

Adani firms make settlement offers in SEBI's public shareholding probe

What's the story

Several entities linked to the Adani Group have filed settlement applications with the Securities and Exchange Board of India (SEBI) over allegations of violating public shareholding norms.

The allegations pertain to four listed companies of the group.

One of the applicants seeking a settlement is Emerging India Focus Funds (EIFF), a Mauritius-based foreign portfolio investor allegedly connected to Vinod Adani, Gautam Adani's elder half-brother.

Settlement proposal

EIFF proposes ₹28 lakh settlement

EIFF has proposed a settlement amount of ₹28 lakh, The Economic Times reported.

Other Adani Group-connected individuals, such as Vinay Prakash of Adani Enterprises and Ameet Desai of Ambuja Cements, have each offered ₹3 lakh to settle the case.

Adani Enterprises has also filed a settlement application after SEBI issued a show-cause notice on September 27.

Decision awaited

SEBI's decision on settlement applications pending

SEBI is yet to decide on these settlement applications.

Notably, at least four entities have filed such requests, and all the Adani entities involved may have done so.

Filing for a settlement is a common response to show-cause notices, as failing to do so within 60 days means losing the option.

Allegations detailed

SEBI's show-cause notices involve 26 entities

The show-cause notices sent by SEBI pertain to 26 entities, including Gautam and his brothers Vinod, Rajesh, and Vasant.

The regulator has asked why these entities shouldn't face action for alleged violations.

The allegations claim that Vinod and his affiliates accumulated over ₹2,500 crore through complex shareholding arrangements in Adani Enterprises, Adani Power, Adani Ports and Special Economic Zone (APSEZ), and Adani Energy Solutions (formerly Adani Transmission).

Probe details

SEBI's investigation into Adani Group's shareholding

SEBI's investigation, which started in October 2020, examined transactions from 2012 to 2020.

The probe discovered that two foreign portfolio investors—EIFF and EM Resurgent Fund (EMR)—and Opal Investments had shareholdings linked to Vinod.

These entities reportedly assisted the Adani Group in faking compliance with public shareholding norms by purchasing shares during public offerings and institutional placements.

Denial issued

Adani Group denies allegations of wrongdoing

The Adani Group entities have denied any wrongdoing, claiming their settlement applications were precautionary measures.

A person close to the group told ET that the entities had also filed responses contesting the charges and sought access to SEBI's evidence.

"The application does not admit or deny the charges but aims to ensure procedural compliance," a source was quoted as saying by The Economic Times.