Adani, Birla now competing in wire and cable industry

What's the story

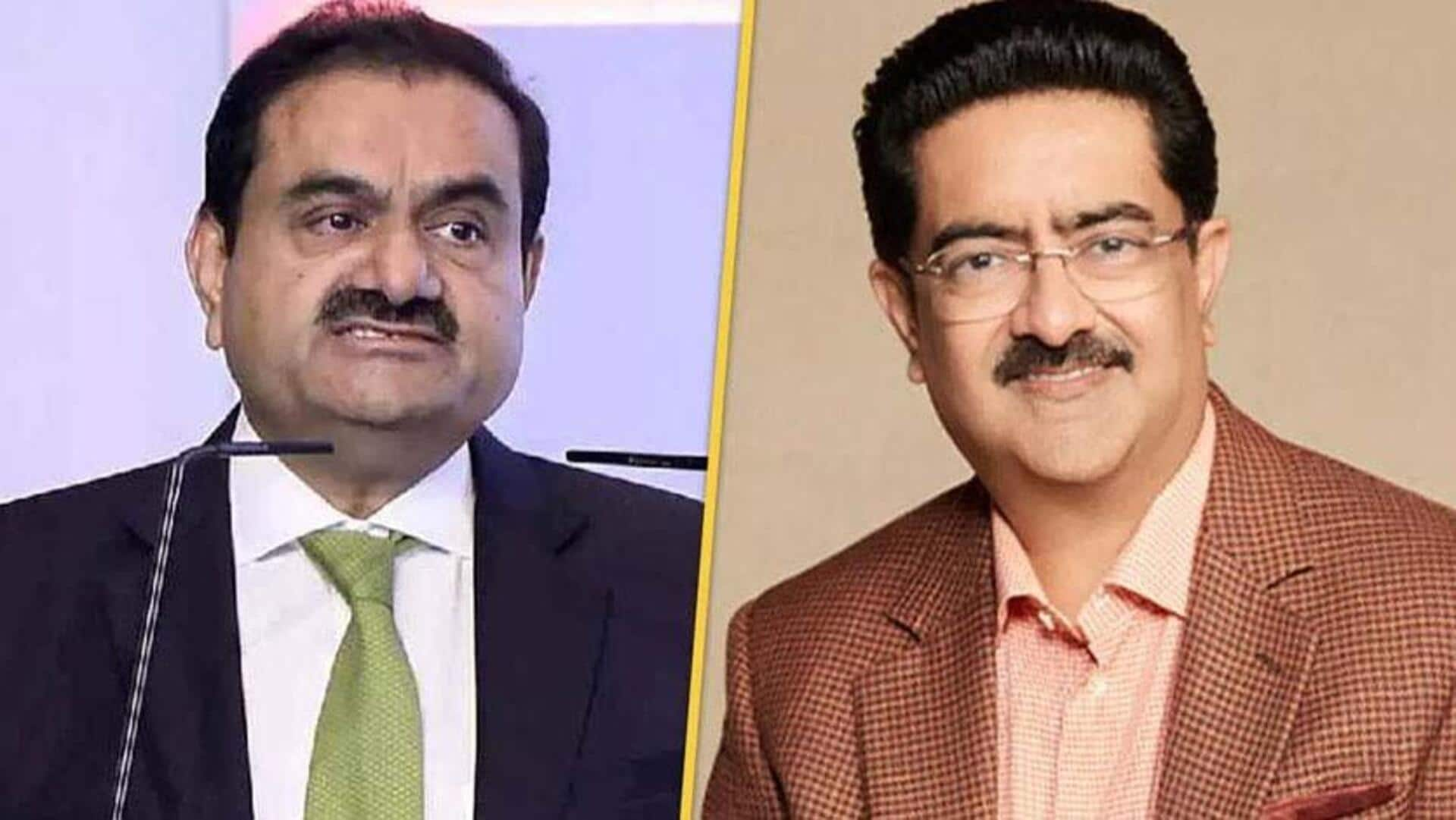

Billionaires Gautam Adani and Kumar Mangalam Birla are taking their business empires to the wires and cables industry.

The move comes after their successful foray into the cement sector, where they have left smaller players behind.

The new market is largely dominated by unorganized players and small businesses.

With both the groups announcing their entry into this fast-growing sector, competition is set to heat up.

Market analysis

Wires and cables industry shows strong growth potential

The wires and cables industry has witnessed a CAGR of 13% in revenue from FY19 to FY24. The industry is slowly moving toward a more organized branded market.

JM Financials termed the wires and cables segment as an "ideal segment for a new entrant with deep pockets."

The ₹80,000 crore Indian cable & wire industry offers an "attractive opportunity," global brokerage firm Jefferies said.

Strategic moves

Adani and Birla's strategies for market penetration

Adani Enterprises has formed a joint venture, Praneetha Ecocables, with Praneetha Ventures to manufacture and sell metal products, cables, and wires.

This comes after the Aditya Birla Group's flagship firm UltraTech Cement announced plans to invest ₹1,800 crore in the wires and cables sector over the next two years.

UltraTech also plans to build a greenfield plant near Bharuch in Gujarat by December 2026.

Distribution challenge

Distribution network crucial for success in wires and cables industry

Analysts say building a robust distribution network will be key to disrupting the wires and cables industry.

Both Adani and Birla enjoy significant brand equity in building materials, but that alone may not cut it.

Aakash Fadia of Yes Securities believes "any new player would need to have significantly higher advertising & promotional spend," adding it could take at least five years to reach existing players' scale.

Market response

Strategies of existing players in the market

Existing players such as Polycab India, KEI Industries, and Havells India have been steadily increasing their market shares.

The share of branded players has increased to about 74% in FY23 from 61% in FY14 and is projected to reach 80% by FY25.

Polycab has bolstered its network via digitalization while Havells adopts an omni-channel approach.

KEI incentivizes dealers and electricians through year-round loyalty programs.