Adam Neumann proposes to reacquire bankrupt WeWork for hefty sum

What's the story

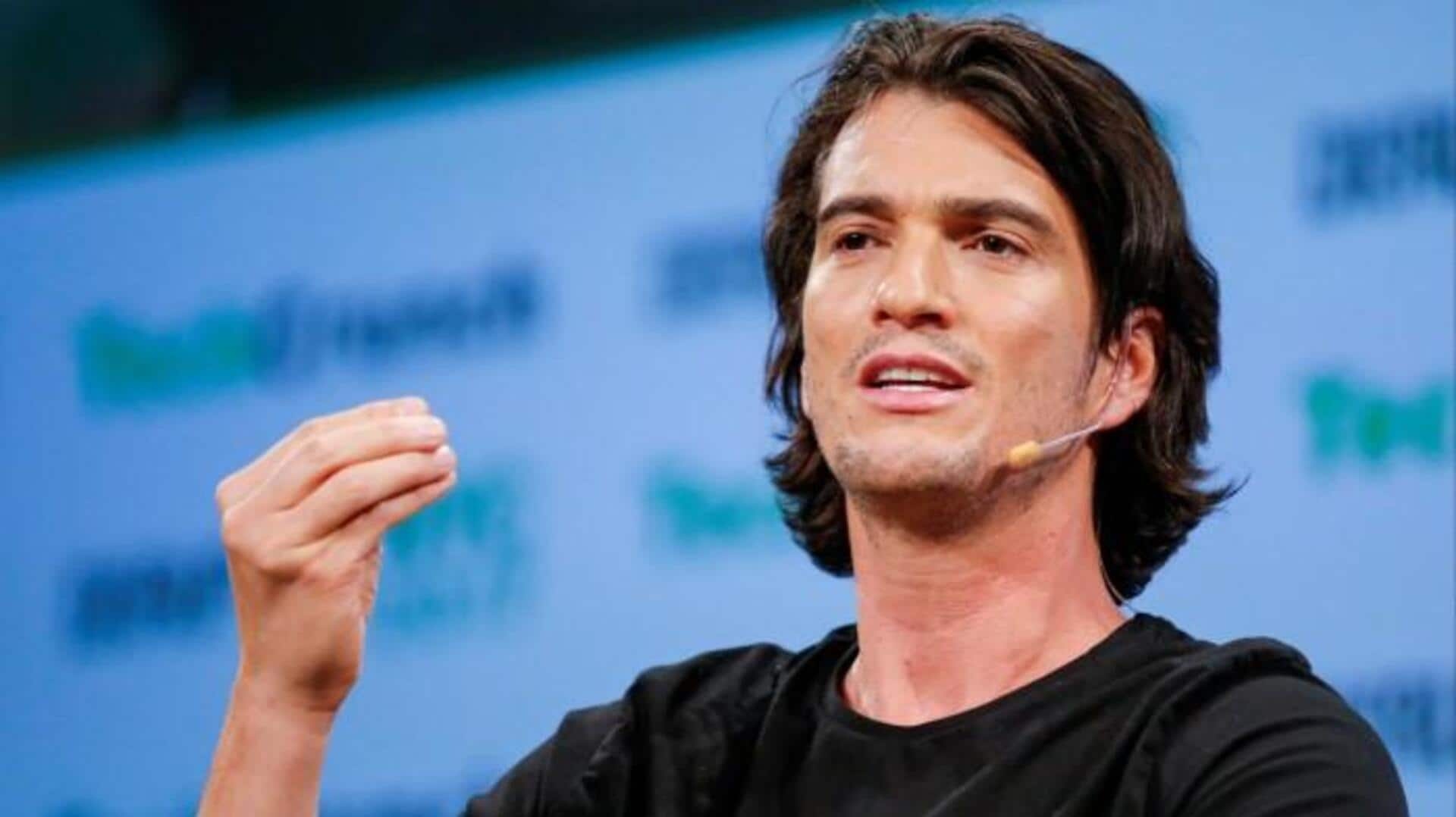

Adam Neumann, the co-founder and ex-CEO of WeWork, has reportedly proposed a bid of over $500 million to reacquire the insolvent shared office space provider.

This news was initially reported by The Wall Street Journal, though the precise financial details of the acquisition are yet to be disclosed.

A spokesperson from Neumann's real estate firm, Flow, confirmed the bid and indicated that it exceeded the figure reported by the publication.

Reinforcements

Financial partners support Neumann's bid

A spokesperson from Flow disclosed that a group of six financial partners, familiar to WeWork and its consultants, put forth the potential bid a fortnight ago.

Despite this development, WeWork is determined to emerge from Chapter 11 bankruptcy protection in Q2 as a "financially robust and profitable company."

The identities of these financial partners remain undisclosed.

Response

WeWork's reaction to Neumann's proposal

In response to the proposal, WeWork communicated via email that it frequently receives interest from third parties.

The company further stated that its board and consultants evaluate these proposals to ensure they align with the company's long-term interests.

Despite ongoing bankruptcy proceedings, WeWork continues to focus on its objective of becoming a profitable firm.

History

Neumann's prior attempt to acquire WeWork

Neumann had previously considered purchasing WeWork out of insolvency with other investors, including Dan Loeb's Third Point, as reported by Bloomberg.

However, insiders clarified that Third Point is not participating in Neumann's current proposal.

A representative for Third Point refrained from commenting on the situation.

Others

Flow bagged hefty funding prior to starting operations

Flow secured a $350 million investment from venture capital firm Andreessen Horowitz at a $1 billion valuation in 2022, even before commencing operations.

The company manages multifamily residential properties, with the objective of promoting a sense of ownership and community among residents.

The specifics of how this venture might impact Neumann's proposal for WeWork remain undisclosed.