Japan invests $2.44 billion to boost domestic EV battery production

What's the story

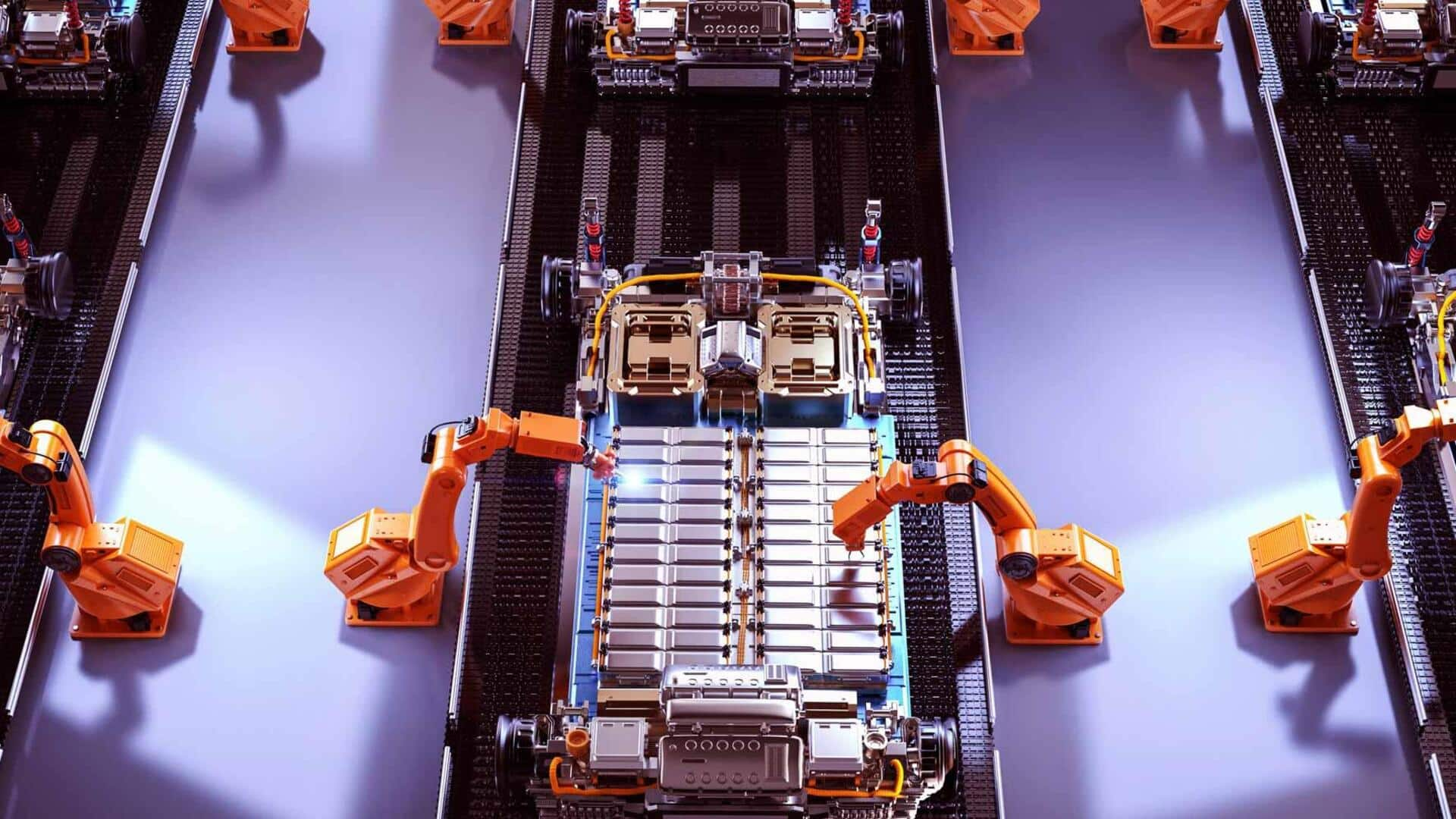

Japan is set to invest a whopping ¥350 billion ($2.44 billion) in subsidies, aimed at bolstering its battery manufacturing sector.

The funds will be allocated across 12 significant development projects, with the goal of enhancing Japan's storage battery production capacity and related components, materials, and devices.

This move comes as a response to the rapidly expanding electric vehicle (EV) market and escalating global competition.

Information

Major automakers to benefit from Japan's subsidy

The beneficiaries of Japan's subsidy include automakers such as Toyota, Subaru, Nissan, and Mazda. Battery manufacturing giant Panasonic is also among the recipients. The aim of these projects is to elevate Japan's position in the global EV battery landscape.

Technological advancement

Toyota's focus on prismatic and solid-state batteries

Toyota, the world's largest automaker by volume, has confirmed that it will use a portion of the Japanese government's grant to develop advanced battery technology.

The funds will be allocated toward the development of prismatic batteries, which are more compact than traditional cylindrical batteries.

Additionally, Toyota is also focusing on next-generation solid-state batteries that offer higher energy density and faster charging times compared to current lithium-ion models.

Toyota aims to achieve an annual battery production capacity of 9 gigawatt-hours (GWh).

Production plans

Nissan and Panasonic's strategies for battery production

Nissan plans to use its share of the subsidy to boost its capacity for producing lithium-iron-phosphate (LFP) batteries, known for being more cost-effective and safer than traditional lithium-ion batteries.

Starting 2028, Nissan's small EVs will use LFP batteries, with a projected annual capacity of 5GWh.

Meanwhile, Panasonic is partnering with Subaru to build new battery production capacity. The company's energy division aims to increase its annual output by 20GWh by 2030, focusing on meeting the growing demand for Subaru's EVs.

Information

Mazda's cylindrical battery approach

Mazda, another beneficiary of Japan's subsidy program, is collaborating with Panasonic to develop cylindrical batteries commonly used in EVs. Mazda also plans to secure extra 6.5GWh of battery capacity annually by 2030.

Market competition

Japan struggles to compete as China dominates global battery market

Japan's drive to expand battery manufacturing comes as Chinese companies lead the global market.

Data from SNE Research shows that from January to July, six of the top 10 battery suppliers were Chinese, holding a combined 65.3% market share.

In comparison, Panasonic, Japan's sole representative in the top 10, saw its market share drop from 7.1% to 4.3% over the past year.

This significant decline underscores Japan's struggle to compete with China's expanding battery industry.