Indian auto industry to reach $300 billion by 2026

What's the story

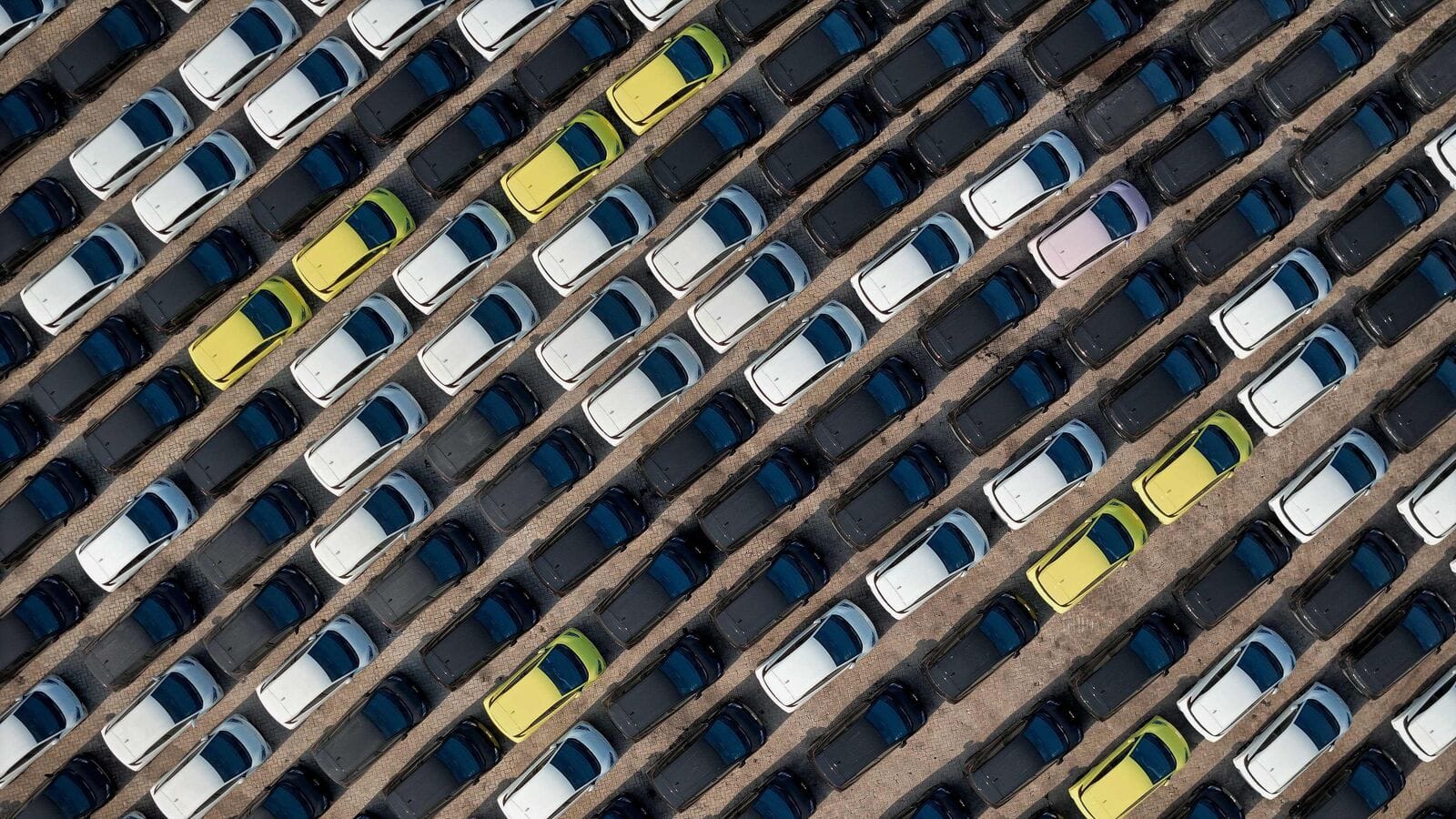

The Indian auto industry, which manufactured a total of 2,325,959 units in March 2024, is projected to reach a market value of $300 billion by 2026.

This anticipated growth is attributed to factors such as increased income levels, urbanization, and the expanding middle class with enhanced purchasing power.

In the first quarter of 2024 alone, the industry produced a staggering total of 7,394,417 units across various vehicle categories.

Production details

Two-wheelers led the market

The first quarter of 2024, saw passenger vehicles making up a significant portion of the production with 1,135,501 units.

Commercial vehicles accounted for 268,294 units, while three-wheelers stood at 164,844 units.

However, two-wheelers led the market with an impressive domestic sale of 4,503,523 units from January to March 2024.

Market leadership

India is world's largest two-wheeler manufacturer

The financial year from April 2023 to March 2024, saw the Indian automotive industry report a total production of 284,347,742 units.

Two-wheelers were the top sellers with 179,743,365 units sold domestically during this period.

This solidifies India's position as the world's biggest manufacturer of two-wheelers and tractors.

FDI inflow

FDI in auto sector at $35.40 billion

The Indian auto sector has attracted significant foreign direct investment (FDI), with an accumulated equity FDI inflow of roughly $35.40 billion, between April 2000 and September 2023.

Government initiatives have also played a crucial role in driving growth in this sector.

In FY23 alone, automobile exports from India reached an impressive figure of 47,61,487 units.

EV growth

India's EV market to become third-largest by 2025

India's shift toward electric vehicles (EVs) is accelerating, with projections indicating it will become the third-biggest EV market by 2025.

An expected 2.5 million vehicles are predicted to be on the roads by this time.

The EV market offers an investment opportunity of over $200 billion over the next 8-10 years, with an expected growth rate of 49% between 2022-2030.

Market trends

Consumer preferences shifting toward larger models

The industry is seeing a shift in consumer preferences, toward larger and more powerful vehicles across all segments.

This trend is evident in the rising demand for Utility Vehicles (UVs), as well as Medium & Heavy Commercial Vehicles (M&HCVs).

Government initiatives such as Make in India, the National Electric Mobility Mission Plan 2020, and the Automotive Mission Plan 2026, further support this growth trajectory.